📈 Most investors have no clear record of their past trades—just cryptic transaction logs buried in brokerage apps.

When trying to assess their performance or improve their strategy, it’s a guessing game.

This edition of Easy Startup Ideas shows you how to build a lightweight, privacy-first app that connects to your brokerage account and helps you track your realized gains, losses, and trading accuracy in one place.

Featured Business - Beehiiv

Beehiiv is the #1 email newsletter platform, trusted by over 25,000 people.

They make it simple to design, automate, and analyze your emails—not to mention, you can earn income passively with their signature Boost feature!

Don’t miss out.

Advertise your business or website here.

Today’s Idea

A lightweight app that connects to your investment account(s) and tracks your realized trade performance — including gain/loss percentages, win/loss ratios, average gain/loss, and overall profitability — giving retail traders a powerful yet simple way to reflect on their trading history and decision-making.

Available Domain: PortfolioPlayback.com

Ideal Customer

Retail investors who use platforms like Robinhood, E*TRADE, Fidelity, Charles Schwab, TD Ameritrade, or Wealthsimple.

Self-directed investors who manage their own portfolios and actively buy/sell stocks or ETFs.

Users of platforms like Seeking Alpha, TradingView, and Reddit’s r/stocks or r/investing communities.

Aspiring or semi-pro traders who want to review their decision-making, not just track balances.

Why It Will Succeed

Fills a real gap: None of the major brokerages or investing apps offer a clean way to view your hit rate, realized gains/losses over time, or average trade return.

Low-friction integration: With broker APIs (Plaid, Alpaca, or direct broker APIs), users can sync their portfolio history with a couple of clicks.

Actionable insights: Traders are obsessed with metrics — knowing your win/loss ratio, average loss vs gain, and dollar-wise outcomes is powerful and addictive.

Platform-agnostic: Doesn’t try to compete with brokers — only complements them.

Sticky behavior: Users return regularly to check updated metrics after every trade, creating a habit loop.

Getting Started and Building an MVP

Required Tools & Platforms

Brokerage Integration:

Use Plaid or Alpaca for brokerage account access. Both support account linking and trade history retrieval.

For U.S. users, Plaid is likely the fastest way to gain wide coverage across brokerages.Code Assistance:

Pair Replit or Bolt.new with Claude AI or GitHub Copilot to help generate or edit data processing scripts quickly.

MVP Features

Connect brokerage account

Import trade history

Display:

% of trades that are gains vs losses

Total dollars gained vs lost

Average gain/loss per trade

Historical chart of realized performance

Privacy-first: no trading or money movement features; read-only data

First Steps

Set up a brokerage connection via Plaid’s sandbox.

Use Python (or Claude + Replit) to process mock trade history into gain/loss metrics.

Build a front-end UI using Glide or WeWeb to display trade stats.

Test user flow: link -> fetch history -> parse data -> show insights.

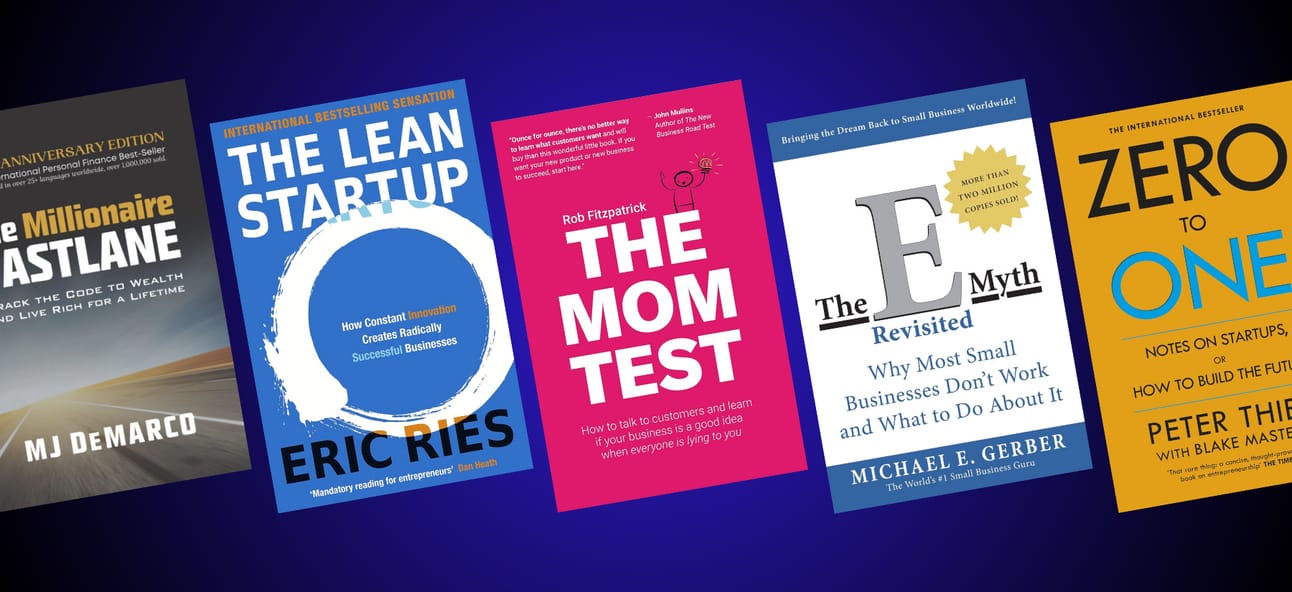

Required Reading for Aspiring Entrepreneurs

If you're serious about starting something — or growing what you've already got — these are the books that’ll actually help.

No gurus. No cringe. Just real takeaways.

Monetization Strategies

Freemium model:

Free version gives users past 30 trades.

Pro version unlocks full trade history, additional metrics, export to CSV, and custom insights.

Insights-as-a-Service:

Monthly report emailed or pushed to user summarizing trading performance, recurring mistakes, and improvement suggestions.

Affiliate integration:

Recommend and link to high-performing trading platforms, research tools, or financial education products for commission.

Custom alerts or AI coaching:

For paid tiers, offer smart summaries using GPT to interpret patterns and give behavioral nudges: “You often sell winners too early.”

Marketing Strategies

Reddit Ads & Comments:

Run targeted ads in subreddits like r/stocks, r/robinhood, and r/investing.

Engage in threads where people vent about brokerage UX — this happens daily.

Twitter/X Threads:

Showcase your own trade history and lessons learned from using the tool. Tag FinTwit influencers.

YouTube Shorts/TikToks:

Show 15-second demos of "before and after" — the moment you realize your hit rate is 30% but you’re still profitable.

Newsletter Placement:

Reach out to investing-focused newsletters (like The Daily Upside or Finimize) for feature sponsorships or barter deals.

AppSumo Launch:

Once you have a polished MVP, launch on AppSumo to attract early adopter finance nerds.

Expanding and Improving

Tag-based journaling: Let users add notes to each trade (“panic sold,” “news reaction,” “earnings miss”) for behavioral pattern discovery.

Benchmarking: Let users compare their performance vs. SPY or other indices.

AI Coach: Integrate GPT-4o to summarize their monthly trading performance and suggest improvements like a real portfolio coach.

Mobile App: Native app experience via FlutterFlow or React Native for power users.

Gamification: Badges for streaks, successful exits, or consistent risk/reward ratio adherence.

Thanks for checking out another edition of Easy Startup Ideas!

If you have any comments or suggestions on how to improve this newsletter, please let us know by commenting below.

As an Amazon Associate and affiliate of various partnership programs, the owner of this publication may receive commissions to linked products or services in this newsletter at no additional expense to the reader.